[ad_1]

“Subbu (Aurobindo’s chief financial officer Santhanam Subramanian),” said Prashant Poddar, a portfolio manager at ADIA, “there are two concerns I will point out. (On) corporate governance, you know, serious work needs to be done there about what the directors are doing. Just because some of them are promoters, they cannot do anything that they want, right?” Poddar also questioned the management on cash utilization.

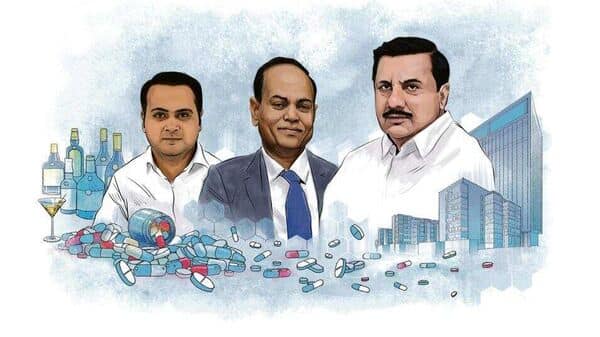

It is rare for a large institutional shareholder like ADIA—the world’s third-largest sovereign wealth fund which manages $790 billion in assets on its government’s behalf— to make such a scathing attack on a company like Aurobindo, which until the end of last year was India’s second-largest pharma company by sales.

Shareholders in Aurobindo have lost 0.5% as against a 50.2% jump in NSE 50 between 1 January 2020 and 24 November 2022. This is even as some pharma stocks have outperformed, riding on the Covid-19 pandemic. Cipla’s stock has surged 137%, while that of Sun Pharma is up 132% during the same period.

Business has lately been tepid. Aurobindo’s revenue declined 5.3% from ₹24,775 crore in the year ended March 2021 to ₹23,456 crore last year. Profits more than halved from ₹5,334 crore to ₹2,647 crore on account of impairments.

But an equally disconcerting worry for shareholders has been on corporate governance and on the tricky issue of other business interests of the promoters of Aurobindo and whether the fallout from those businesses could impact the firm.

Many investors continue to be reluctant to invest in the company, two investors who spoke on the condition of anonymity said, despite Aurobindo’s shares being the cheapest among pharma majors.

A detailed questionnaire sent to Aurobindo seeking comments remained unanswered.

So what is going on inside Aurobindo and why are investors restive?

Arrest of a scion

On 10 November, the scion of one of Aurobindo Pharma’s promoter families got embroiled in an alleged corruption case pertaining to the award of licenses to liquor stores in New Delhi. Sarath Chandra Reddy, the eldest son of PV Ramprasad Reddy, the co-founder of Aurobindo, was arrested by the Enforcement Directorate (ED).

The ruling Aam Aadmi Party (AAP) envisaged a new liquor policy for Delhi in November last year, under which the government would exit from alcohol retailing and instead allow private retailers. Under the new policy, Delhi was to be divided into 32 zones.

Soon, allegations of cartelization and corruption surfaced, prompting ED to start an investigation.

ED, in its complaint, calls Sarath the “kingpin” and says he along with a few of his friends paid ₹100 crore in kickbacks for what the investigation agency estimates would have given him at least a third of the total liquor market in the National Capital Region.

“SR (Sarath Reddy) was effectively controlling 5 retail zones through his group company i.e. Trident Chemphar Pvt Ltd and proxy entities namely, Organomixx Ecosystems and Sri Avantika Contractors in violation of the Excise Policy which barred any person to control more than 2 retail zones,” says ED in its complaint, a copy of which Mint has reviewed.

Even though the AAP has dismissed allegations of impropriety, the party has jettisoned the new liquor policy.

Sarath, who joined the board of Aurobindo in September 2007, was wholetime director and oversaw procurement and IT at the pharma company.

Shares of Aurobindo slumped 12% to ₹464 on 10 November, after the news of Sarath’s arrest emerged.

The nine-member board of Aurobindo moved swiftly to troubleshoot. On 12 November, the company said it had relinquished Sarath from all executive responsibilities but allowed him to retain his position on the board.

₹24,775 crore in the year ended March 2021 to ₹23,456 crore last year.” title=”Aurobindo’s revenue declined 5.3% from ₹24,775 crore in the year ended March 2021 to ₹23,456 crore last year.”>

₹24,775 crore in the year ended March 2021 to ₹23,456 crore last year.” title=”Aurobindo’s revenue declined 5.3% from ₹24,775 crore in the year ended March 2021 to ₹23,456 crore last year.”>

View Full Image

Echoes of the past

The move to curtail Sarath’s role on the board has echoes of his father Ramprasad Reddy’s removal from Aurobindo’s executive ranks in 2012, which analysts linked to a Central Bureau of Investigation (CBI) probe in a corruption case against YS Jaganmohan Reddy, now the chief minister of Andhra Pradesh.

In the disproportionate assets case against Jaganmohan Reddy, both Ramprasad Reddy and his co-founder at Aurobindo, Nithyananda Reddy, were named in the preliminary report by the CBI as having benefited from favourable decisions by YS Rajasekhara Reddy, Jagan’s late father. Aurobindo had at the time denied that the organizational change was linked to the probe.

Although serving in a non-executive role now, Ramprasad Reddy is seen to be involved with the company’s affairs. Post-earnings analyst calls are still led by Nithyanand Reddy, who is vice chairman and MD, and Ramprasad Reddy (non-executive director), although both were conspicuously absent on 14 November.

Aurobindo was founded by the duo in 1986. The founders named the company thus as the first factory came up in Puducherry, the adopted home of Shri Aurobindo, the spiritual guru.

As the company achieved scale and success, the bonds between the two friends also grew closer.

Nityananda Reddy married a cousin of Ramprasad. Later, Nityananda’s daughter, Kirthi Reddy, married Sarath. A few years back, Sarath and Kirthi separated and Sarath married Kanika Tekriwal Reddy, who now runs the private air charter service, JetSetGo.

Here’s what ED’s complaint against Sarath says: “SR (Sarath Reddy) had direct control of 5 retail zones (Trident Chemphar Pvt Ltd and proxy entities namely, Organomixx Ecosystems and Sri Avantika Contractors) and along with other members of the cartel also collectively controlled 4 zones. This cartel effectively controlled about 30% of the Delhi liquor market by series of illegal activities involving giving kickbacks, using benami and proxy entities and conspiracy with various stakeholders in the liquor industry.”

Trident Chemphar Pvt Ltd is one of the promoter entities in Aurobindo Pharma. Both Sarath and his younger brother, Rohit Reddy (who is not a director of Aurobindo but runs at least half a dozen privately-held real estate firms) have in the past been directors of Trident Chemphar, which was founded in 2007.

Political crossfire

Even before his arrest by ED, trouble was brewing for Sarath on his home turf for his alleged involvement with a distillery that is at the heart of a heated political controversy in Andhra Pradesh. The opposition Telugu Desam Party has alleged that Adan Distillery is linked to chief minister Jagan Mohan Reddy’s close associates (the CM’s close advisor and former Rajya Sabha MP Vijaysai Reddy’s daughter is married to Sarath’s brother Rohit) and received contracts worth more than ₹2,400 crore from the state nodal agency for supplying alcohol. Jagan Reddy and YSR Congress have denied the allegations.

State opposition leaders as well as Raghurama Krishnam Raju, a member of parliament and now a rebel member of Jagan’s YSR Congress Party, have alleged that Sarath and his younger brother Rohit are the founders of Adan Distillery.

Mint could not independently verify Raju’s claims. Adan Distillery was started by two directors—Srinivas Kasichayanula and Anirudh Reddy Muppidi, who owned 5,000 shares each, according to financials filed by the company with the Ministry of Corporate Affairs.

Kasichayanula, who continues to be the second director of Adan Distillery, was also a director of two privately-held companies, Shreas Biologicals Pvt Ltd and Aurobindo Lakeview Developers Pvt Ltd, in the past. Both these companies are owned by Rohit Reddy.

Kasichayanula was also the chief financial officer of Trident Chemphar Pvt Ltd, the company that has been named in the ED complaint with regard to the alleged Delhi liquor policy scam, until he resigned in April 2020.

This is not the first time accusations involving conflict of interest and promoters’ family members have dogged Aurobindo pharma. In 2019, Aceto Corp, a publicly listed pharma company in the US, accused Aurobindo of sabotaging its business, leading to its bankruptcy. Aceto had acquired a Cayman Islands-based company Citron Pharma LLC, which had secured a commercial partnership with Aurobindo to supply generic drugs it would in turn sell in the US market. Aceto alleged in court that part of Citron equity was owned by a relative of Ramprasad Reddy and once that equity was sold, Aurobindo lost interest in the contract and reneged on terms. Aurobindo has vigorously denied the charges.

Desire to diversify

A few analysts have questioned if it is time for Aurobindo to have a professional CEO run the operations. Prakash Agarwal, deputy head of Research at Axis Capital, brought the investor’s misgivings to the fore on the absence of a CEO in an interaction in August this year.

But Ramprasad Reddy was clear.

“As of today, we are not looking (for a professional CEO). We are happy with the present system,” responded Reddy.

Some believe the latest incident would be a mere blip for Ramprasad Reddy.

“Entrepreneurs have encounters, but they also come out of it,” said Mahesh Singhi, founder of Singhi Advisors, a Mumbai-based boutique investment bank. Singhi, who has pitched deals to Reddy, argues that even though some may question if these diversifications by the promoter are taking away the founder’s bandwidth from the mainstay pharma business, “it is a bet the promoters are taking”.

A board member at Aurobindo, who spoke on the condition of anonymity, maintains that it is business as usual and the family and company will be able to come out of this soon.

“This development has nothing to do with Aurobindo Pharma… we have already removed Sarath’s executive position. Now, lawyers are on the case and everything will be clear over time,” said the executive.

Business groups from Telangana and Andhra Pradesh have a history of diversifying into other businesses and also for political linkages.

“When you are an entrepreneur from AP, you are likely to be wedded to real estate,” said a consultant who works with many business families, including the promoter of Aurobindo. “It has been common for AP entrepreneurs to start in one business and then branch out into real estate or infrastructure. Before investing in airports, power, and roads, GMR made money in ING Vysya. The GVK group was previously in building materials and hotels before venturing into airports and power”

It doesn’t always end well, as illustrated by the downfall of Ramalinga Raju, who built Satyam into one of India’s top technology services companies before diversifying into real estate and ending up in prison for fraud.

The question before Ramprasad Reddy would be an honest appraisal of whether the promoter families’ real and imagined involvement in other businesses has started to dent investor sentiment around Aurobindo. Just as importantly, if these are proving to be distractions for the listed company’s management. Last week, Mint reported that at the end of the July-September period, Dr. Reddy’s Laboratories and Cipla had become the second and third largest pharma companies by sales, while Aurobindo had been relegated to the fourth position.

Download The Mint News App to get Daily Market Updates & Live Business News.

[ad_2]

Source link

John Miller has been writing about science, gaming, and tech culture for over a decade. He’s a top-rated reviewer with extensive experience helping people find the best deals on tech and more.