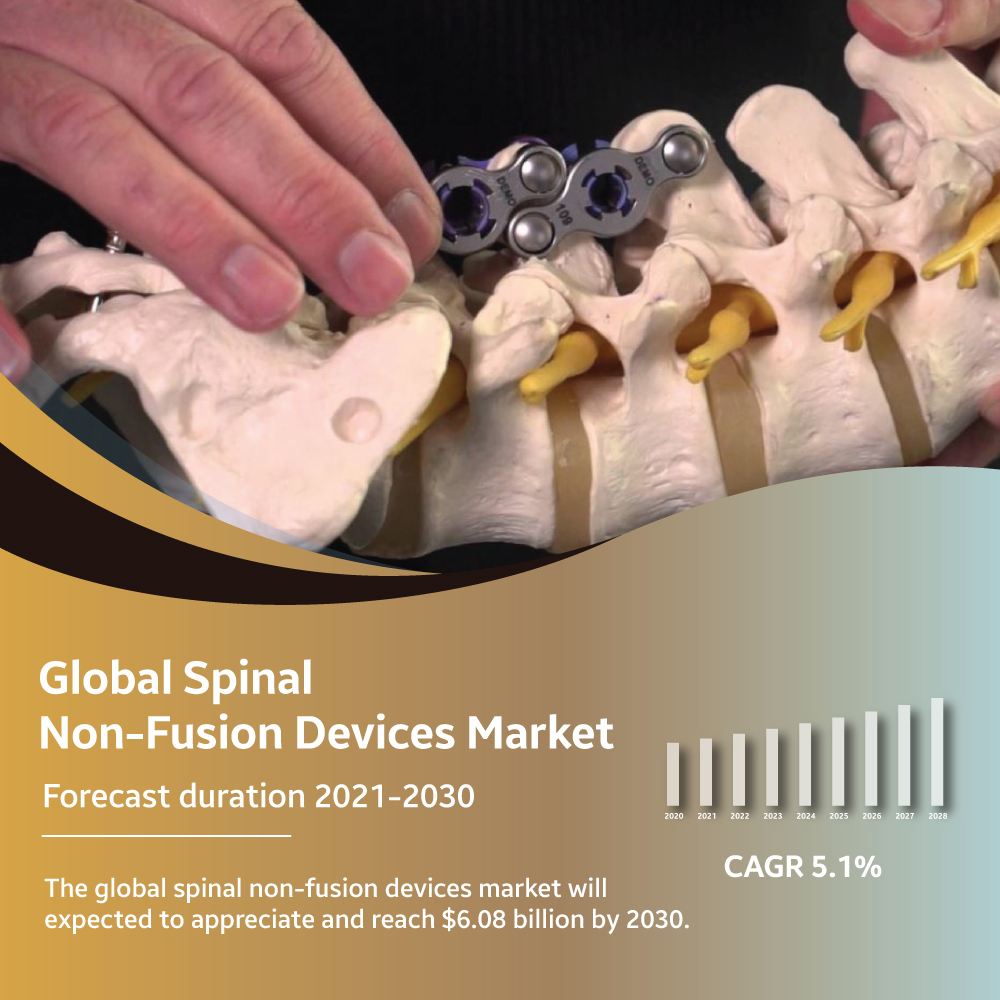

Non-fusion spinal devices are medical tools used to treat anatomical surgical abnormalities of the spine without fusing the vertebrae together. These symptoms necessitate surgical procedures as one of the primary therapeutic options since spinal problems can significantly lower patients’ quality of life. After surgery, non-fusion spinal devices are put into the patient’s body to aid in the stability and mobility of the patient. Growth sparing devices and artificial discs are two of the most important non-fusion devices. Some benefits of spinal non-fusion devices suggest that non-fusion devices are a better option for patients than fusion devices, including prolonged healing time, bone graft donor site morbidity, and neighboring segment deterioration.

The market value of spinal non-fusion devices in 2021 was USD 3.88 billion and will be worth USD 6.08 billion by 2030, growing at a 5.1% CAGR during 2021-2030.

The increased prevalence of spinal problems, the aging population, the benefits of spinal non-fusion treatments over fusion procedures, and technological advancements in product development are the main factors driving the market for spinal non-fusion devices.

Market Dynamics

Drivers

The market for spinal non-fusion devices is expanding due to various factors, including the rising prevalence of spinal illnesses. The rising senior population, the benefits of spinal non-fusion devices over spinal fusion devices, and technological advancements in product development are the main factors driving demand for these devices. Therefore, the market for spinal non-fusion devices will increase due to ongoing technical advancements and the advantages and versatility of dynamic stabilization devices, among other products.

Restraints

Due to a ban on orthopedic services by hospitals and clinics to stop the spread of the COVID-19 virus and intense pressure on hospitals to treat COVID-19 patients, the global COVID-19 pandemic and lockdown situation in some countries has revealed some challenges in the spinal non-fusion devices market. An estimate of the cancellation rate for orthopedic surgery was 6.2 million out of 7.6 million cases, or about 82.0 percent, according to a report in the Annals of Medicine and Surgery.

Opportunities

The need for spinal fusion devices is rising as minimally invasive surgery (MIS) gains popularity. For a variety of reasons, including less discomfort, a speedier recovery time, & a reduced chance of tissue injury, surgeons prefer MIS to open surgery. Numerous bone conditions are addressed using minimally invasive techniques. The most frequent & very effective treatment option for a variety of degenerative bone illnesses, spine injuries, and structural flaws, over 400k spinal fusion procedures are performed annually in the United States.

Market Segmentation

Type insights

Dynamic Stabilization Devices held the greatest market share in 2020. Devices that are available include facet replacement products, Pedicle screw-based systems, and interspinous process spacers. The segment’s dominance is due to stiff spinal implants for fusion technology. Furthermore, the segment’s expansion is considerably aided by the rising incidence of spinal degenerative disc illnesses. Additionally, the adoption of BioFlex systems and other technological innovations that alter therapeutic procedures, such as biochemical advancements, will fuel the segment’s growth.

End User Insights

Hospitals held the largest share of the End-user segment in 2020. This is because spine surgery payment policies are favorable and because spine navigation software is widely used. Spinal surgery conducted at ambulatory surgery facilities can save USD 140 million annually, as per the journal Neurosurgery.

Regional Insights

In 2020, North America owned the largest percentage of regional market. Advanced fusion surgery is encouraged by favorable payment policies, elderly patients hoping for greater levels of function, and technical improvements, which have contributed to the growth of the spine surgery industry in the United States. The growing incidence of spinal cord injury in the United States is approximately 54 per one million people, or about 17,810 new SCI-related cases each year, according to the (NSCIS) National Spinal Cord Injury Statistical Centre’s 2019 SCI Datasheet.

Key Players

- DePuy Synthes

- LLC

- Medtronic

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- NuVasive, Inc.

- Globus Medical, Inc.

- Paradigm Spine

The market value of spinal non-fusion devices in 2021 was USD 3.88 billion and will be worth USD 6.08 billion by 2030, growing at a 5.1% CAGR during 2021-2030. Numerous factors, including the increasing prevalence of spinal illnesses, are driving the growth of the spinal non-fusion device market. The key drivers of demand for these devices are the aging population, the advantages of spinal non-fusion devices over spinal fusion devices, and technological breakthroughs in product development.

I am a professional writer and blogger. I’m researching and writing about innovation, Entertainment, technology, business, and the latest digital marketing trends click here to go website. Follow my blog here & Visit my website here.