[ad_1]

“I’ve been trying to get my name removed [from the company’s rolls] but to no avail. An ex-colleague, who had onboarded me, kept delaying it, and now his phone is always switched off,” the Bihar resident told Mint over the phone.

View Full Image

He had joined Su Hui Technology Pvt Ltd in Gurugram in August 2021 as director, after months of joblessness. It was a new firm—it had been incorporated a little over a year ago. It promised him a ‘proper’ job once the company took off. But he didn’t sign a contract, neither did he receive any money for these directorships, nor get any job, he claimed. A couple of months later, he panicked when he saw a Chinese national mentioned as an ex-director at Su Hui. This was when the government had turned the heat on Chinese companies, cracking down on loan apps linked to China and increasing scrutiny of foreign direct investment from Beijing.

You might also like

Walmart will boost Flipkart with $3bn to challenge rivals

Why Reliance investors remain unimpressed

After Sep quarter show, ITC’s stock is still lit

A PLI scheme to defend power grids from Chinese cyberattacks

The Su Hui director said that a sinking feeling had set in: He realized he had been a “dummy” director all this while.

His fears only deepened in September 2022, when Su Hui was named, along with five other firms—Lillian Technocab Pvt Ltd, Shigoo Technology Pvt Ltd, Mad-Elephant Network Technology Pvt Ltd, X10 Financial Services Ltd, and Nimisha Finance India Pvt Ltd—by the directorate of enforcement (ED) in an investigation into crypto and loan apps.

The 31-year-old man said that he had no awareness of Su Hui’s business, and has not yet been summoned by an investigating agency.

But Su Hui appears to be only one thread in a larger web of deceit.

Officials of the Serious Fraud Investigation Office (SFIO) under the ministry of corporate affairs (MCA) suggest these companies have come up on their radar too, as part of a larger investigation into a racket of shell companies with Chinese links.

The term “shell company” usually refers to a firm with no active business and is sometimes misused for tax evasion, money laundering, hiding ownership, etc. The companies mentioned above have been involved in all kinds of app frauds related to insta loans, crypto, job offers, gaming, dating, and so on, said the SFIO officials. More interestingly, damning money and document trails from these companies all lead to one firm: Jilian Consultants India Pvt Ltd. This is the untold story of the company accused of spinning a big maze of shell firms and fraudulent loan apps—and its China connection.

How it began

Jilian Consultants India Pvt Ltd was incorporated in August 2017 in Delhi, and was later shifted to Gurugram. “We are a Chinese-invested professional consultancy company in India, providing various professional services to Chinese-invested companies in India,” a Jilian India spokesperson told Mint over email. Simply put, it helped companies funded by Chinese money to navigate legal and regulatory requirements in the Indian environment.

It was founded by Wan Jun (alias Aliena Wan), a Chinese national, and an Indian (Sridharan Unni Krishnan), who left the company after six months. His replacement of sorts, Sakshi Bansal, also left the company in five months. One of its directors, Dortse, is one of the prime accused in the MCA’s investigation and was arrested on 10 September. He is a Tibetan refugee, and has no family in India, said his school principal. Even his official documents mention the address of the school in Mandi, Himachal Pradesh, under his address declaration.

Jilian India is a subsidiary of Jilian Hong Kong, which owns 99.99% of its shares, according to the documents uploaded on the MCA website on 27 October 2021. In its official reply to Mint, however, the Jilian India spokesperson denied it was a subsidiary of Jilian Hong Kong.

As of now, the SFIO investigation is focused on 32 companies, as well as Jilian India, which is the centrepiece of the entire puzzle, said SFIO officials aware of the matter. They did not want to be named.

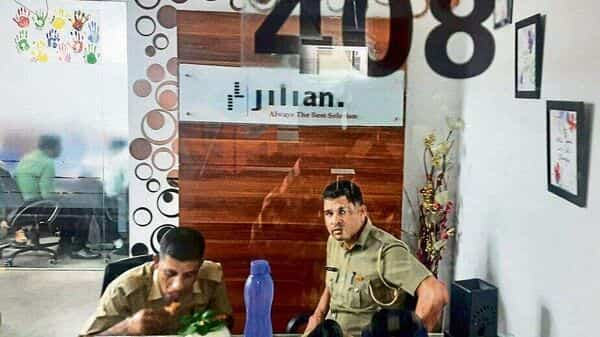

Jilian’s office premises in Gurugram was raided by the Registrar of Companies (RoC), Delhi, officials on 8 September. They seized “boxes filled with company seals and digital signatures of dummy directors”.

Prima facie, all the companies under investigation appear to have been incorporated by Jilian, and to some extent were “controlled” by it, said an SFIO official. “Control”, according to Section 2 of the Companies Act, 2013, can also be indirect, and not always through shareholding or management, argued the official.

The ED also suspects the involvement of Jilian in companies involved in these frauds.

Take, for example, the FIR (first information report) filed in October last year at the Cyber Police Station of Kohima, Nagaland, which led to the investigation by the ED. The complaint, made on behalf of several victims, revealed they had been conned by WhatsApp messages promising high returns if they invested in “HPZ tokens”, informed an official aware of the matter. The investigation revealed that the HPZ token website was operated by Lillian and Shigoo, said the ED in a press release on 16 September 2022. Do Lillian or Shigoo have any connections with Jilian? Here’s what Mint found.

Follow the trail

In order to establish the nature of association between the companies named in app frauds and Jilian India, Mint sifted through the evidence. We found multiple close links between Jilian and at least five companies—Su Hui, Shigoo, Yellow Tune, Mad-Elephant and Aliyeye Network Technology India Pvt Ltd—named by the ED in its raids in August and September 2022.

Su Hui’s and Shigoo’s incorporation documents, accessed from the MCA website, were endorsed and signed by Rajni Kohli, a company secretary. She is a former employee, Jilian admitted in its reply to Mint, but added that she had “left a long time ago”. These documents were signed in June 2020 and April 2021. A Facebook post by Jilian’s account establishes that she was with the company until May 2021 at least. Kohli was arrested in June last year by Delhi Cyber Police for helping create a number of shell companies. She was also listed, in a letter from February this year by MCA, among many company secretaries who had indulged in “professional misconduct”. This letter mentions both Su Hui and Shigoo among several companies she helped create.

The official email ID on the documents of MCA for four out of five of these companies (Su Hui, Shigoo, Mad-Elephant and Aliyeye) is the same: [email protected]. But why would any legitimate company use the name of a service provider in its official email ID? Are these companies linked at the source if they have the common ID?

In June and July 2021, two former directors of Shigoo sent their resignation emails to [email protected], marking a Jilian India employee. One of them even asked for the acceptance of the resignation on the email, as if he was reporting to his manager.

Two of the companies, Yellow Tune and Mad-Elephant, used the same registered address in Bengaluru as that of Fininty Pvt Ltd, which is 99.99% owned by Jilian India. The address is of a virtual or co-working space called BricSpaces, which confirmed that both Yellow Tune and Fininty were recommended by a Delhi-based office solutions firm, Team CoWork. Both were registered at the address within a span of two days in March 2021. Team CoWork confirmed that the original reference for both came through Jilian India. Mad-Elephant was recommended to BricSpaces through FlexiSpaces, which has not yet confirmed the original source of reference.

BricSpaces stated that upon finding that many of these entities had misused the space, it sent a letter to the RoC, Bengaluru, in September this year asking for the removal of addresses of 246 companies, whose agreements had already expired. Another 30 companies used the address even without submitting proper documents, it added. BricSpaces said that it is a victim at the hands of these unscrupulous companies.

Another SFIO official, however, holds a different view. “Over a period of time, they have provided their space to around 1,200 entities (both companies and proprietorships) for legal purposes. But it’s impossible to simultaneously provide space to hundreds of companies. Each company would require a locker because it is mandated to maintain all official records (certificates, board documents, financials, etc) at its registered address.” BricSpaces said that it charged a fee of ₹6,000 per annum for its service, which the official said was too low for such a service in Bengaluru. Fininty, Yellow Tune and Mad-Elephant did not maintain a locker space with it, confirmed BricSpaces.

Jilian Consultants did not comment on any of the above linkages, when Mint sought a response over email.

In its earlier reply to Mint, it was emphatic that “it fully complied with all relevant local Indian regulations including (but not limited to) prevailing Companies Act, Department for Promotion of Industry and Internal Trade, Ministry of Home Affairs and RBI regulations. We did not incorporate any so-called shell company”.

Dummy directors

Suspiciously, all these companies have had multiple directors who stuck around for just 4-6 months, as was true for at least two ex-directors of Jilian.

One such former director of Yellow Tune Technologies admitted to Mint that he had nothing to do with the operations of the company, but his signature is present on a few board documents.

In a few cases, the directors have been rather young. For instance, Jilian India’s 99.99%-owned subsidiary, Fininty Pvt Ltd, had in January 2021 a director who had just turned 18 in December 2020.

According to a former Jilian India employee, the India employees never directly interacted with clients —they processed the paperwork and provided the information needed. The Chinese managers dealt with the clients, many of them from China, he added. The Indian directors (such as the 31-year old-man from Bihar) were usually a front, he admitted. The Companies Act, 2013, requires a private company to have a minimum of two directors; at least one director should have stayed in India for at least 180 days in the previous year.

The officials squarely reject this line of arguments. “How can the real owner of a company sitting in China perform transactions in India, without having any support here?” asked the SFIO official cited earlier. Any transaction requires facilitating agreements and liaising with banks or non-banking financial companies and payment gateways here in India, which were likely performed by Jilian’s local employees, he added.

The scam

How big is this racket? The SFIO officials say it is hard to pin a number down, as “new facets and new players” are being uncovered as the investigation progresses.

By denying that Jilian India is a subsidiary of Jilian Hong Kong, are the big fish abandoning Indians to fend for themselves? Legally, officials say, the dummy directors can be held responsible for the malpractices at their company during their tenure. “Companies work on the principle of legacy. An ex-director can always be asked to explain something even if it’s discovered years later,” said one of the SFIO officials. A number of these were young men who were ignorant, but not all. Some of them acted out of greed, expecting a kickback, though they did not call the shots, he added.

The ex-employee of Jilian quoted above expressed his disappointment at the contrasting fates of the owners of Jilian (who are in China), and its India employees. “We are regularly being asked to present ourselves for the inquiry. We have no jobs, and cannot look for a new one because you never know when you would be called for the investigation.” And, what was all this for? For a salary of a few thousand rupees, he said.

The SFIO official said that while the focus now is on 33 companies, “the net could be expanded if required.” Is Jilian the mastermind behind all Chinese-linked app frauds we have heard of in the last couple of years? “Even if it’s not the mastermind, it’s a key player,” said the first SFIO official. “And who knows, there could be many Jilians”.

Elsewhere in Mint

In Opinion, Vivek Kaul tells why our love of government jobs is bad for the economy. Pranjul Bhandari suggests a two-pronged strategy for India’s external balances. Andy Mukherjee writes on what Reliance will sell next to someone who’s already guzzling data.

Download The Mint News App to get Daily Market Updates & Live Business News.

[ad_2]

Source link

John Miller has been writing about science, gaming, and tech culture for over a decade. He’s a top-rated reviewer with extensive experience helping people find the best deals on tech and more.