[ad_1]

Union home minister Amit Shah was the chief guest.

“Ours is not a formal relationship,” Shah told the audience during his address. “It is a friendship that has blossomed over the years by virtue of our involvement in sports–first in chess and then cricket.”

Shah was talking about N Srinivasan, the company’s vice-chairman and managing director. In the past, both Shah and Srinivasan headed the chess and cricket associations in Gujarat and Tamil Nadu, respectively.

Under normal circumstances, this function would have been dismissed as one where a company was celebrating an important milestone, its 75 years of existence. But then, these are unnerving times for the cement industry—a fear of being acquired has gripped many companies. Media reports have suggested that India Cements is a prime target for larger cement players looking to consolidate the market.

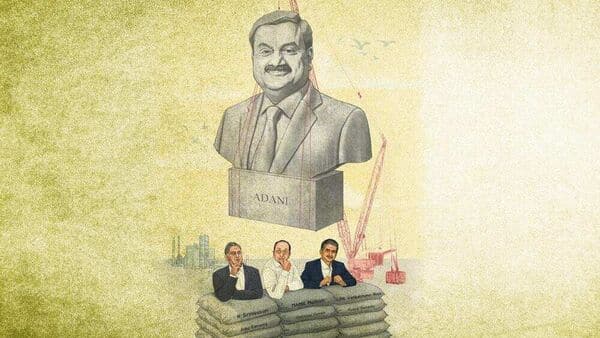

In May this year, billionaire Gautam Adani, the chairman of conglomerate Adani Group, forayed into the cement business by acquiring Swiss building materials major Holcim AG’s cement operations (Ambuja Cements Ltd and ACC Ltd) in India for $10.5 billion. The buyout gave the group about 70 million tonne (mt) capacity and, overnight, it became the second-largest cement producer in the country. Aditya Birla group’s UltraTech Cement Ltd is the largest player with an output of 115mt.

View Full Image

Adani did not stop here. In a speech on 17 September to mark the completion of the Holcim deal, he laid out his vision. “While India is the second largest producer of cement in the world, our per capita consumption is just 250 kg compared with 1,600 kg of China. There is almost 7x headroom for growth,” he said, while announcing a plan to double the group’s cement capacity to 140 mt in the next five years. It was not empty rhetoric. The group immediately said that it will infuse ₹20,000 crore into the business which, along with existing funds, would create a mammoth war chest of ₹30,000 crore.

These moves set the cat among the pigeons. Incumbent players—large, medium, and small— rushed to the drawing board and began charting scenarios on how the future will play out. Companies in south India, particularly, fear that they will bear the brunt of the consolidation.

Srinivasan, through the celebrations, perhaps wanted to convey that he is well connected, too. At least, that’s what people closely associated with the cement industry took away from the event—any attempt at a hostile takeover could be both difficult and costly.

Head south for growth

Adani’s ambition to double capacity in just five years cannot happen organically. Setting up green-field plants is both time-consuming and laborious, considering the approvals and other requirements. Ensuring the availability of limestone—a key input—is another challenge. It is also not lost on other cement players that acquisition has been the preferred mode of growth for the Adani Group in the past.

South India makes sense for Adani for a variety of reasons.

For starters, not much capacity is available in the west, north, or central India for buying. These regions are dominated by large players such as UltraTech, Dalmia Bharat Ltd, and Shree Cement Ltd—apart from Adani now. On the other hand, south India, despite being the largest producer of cement (it accounts for 197 mt of the nation’s 642 mt nameplate capacity), is highly fragmented with as many as 43 players.

That apart, of Adani’s 70 mt capacity today, only about 9 million (little over 10%) is in south India. Even this capacity, located in north Karnataka, feeds the south Maharashtra market. Thus, south India offers a huge headroom for growth.

There is yet another reason. “Competition Commission of India (CCI) thresholds for market shares will be a key determinant of who expands how much in a market,” says Hetal Gandhi, director–Research, CRISIL Market Intelligence and Analytics. In other words, it will be easier for Adani to acquire capacity in the south than in other regions without raising the regulatory red flags.

For Adani, capacity in the south is also inviting as many players here are financially stretched. They have been battling a huge surplus for the last decade. The region’s operational capacity is 150 mt but consumption is just about 80 mt with average capacity utilisation at 60%. This, after shipping out 15 mt to Maharashtra and the eastern region.

Consequently, cement is sold at a discount to north, east, or western regions. A price increase is attempted frequently but they rarely hold as players fight for market share. Srinivasan alluded to this at a recent earnings call. “Cement is a product where you can choose volume or you can choose price. If you choose volume over price, you will have a problem,” he said.

Things have only gotten worse with the recent geopolitical tensions, which resulted in a sharp increase in the prices of coal and fuel. India Cements posted a net loss of ₹113.26 crore in the second quarter of 2022-23. “The loss is the highest in history so far,” Srinivasan said. He blamed it on the inability to increase prices to recover higher costs. Ramco Cements Ltd reported a 98% drop in its net profits despite a 19% increase in revenues. Its managing director, PR Venketrama Raja, told analysts that the EBITDA (earnings before interest, taxes, depreciation, and amortization) per tonne of ₹582 was one of the lowest in eight years. The story is same with other companies and the balance sheets of almost all of them are stretched.

Being most vulnerable, what worries the southern players is Adani’s ability to raise funds. An entrepreneur, who did not want to be identified, jokes that Adani has a genie who grants him unlimited funds. He points to the Holcim acquisition. Initially, JSW Group was the highest bidder offering $7 billion as compared to Adani’s $6.4 billion. But the speed at which Adani raised the funds got him the deal, he added.

Also, Adani is willing to pay a significant premium to acquire the capacity he wants. His $161 per tonne payment for Holcim is way higher than the $90 that Nirma Group paid for Emami Cement Ltd in 2020 and $100 that UltraTech paid for the cement business of Century Textiles and Industries Ltd in 2018.

Survival mode

So, how are the southern players preparing for what is to come?

Those who are weak and without a clear succession plan want to sell out. They are hoping that the impending consolidation boom in the cement sector will give them a good valuation. It is not just Adani who is on the prowl. UltraTech too is. Atul Daga, executive director and CFO at UltraTech, made this clear in a recent earnings call. “…The geography is wide open for UltraTech to consolidate through inorganic routes also. As and when opportunity surfaces in any part of the country, we will examine it,” he said.

Dalmia Bharat and Shree Cement have also talked of a similar strategy.

Smaller players who want to stay in the business are aggressively cutting debt and cleaning their balance sheets. They want to be liquid enough to live through these challenging times.

Mid-size businesses are cutting debt, too. India Cements recently sold its Madhya Pradesh assets (mining leases and limestone-bearing land) to JSW for ₹600 crore. This money will be used to pay off debt and meet working capital needs. Srinivasan has articulated that the company is open to selling non-core and other assets, if need be.

Players like Ramco Cements are trying to improve margins by selling their premium branded cement. Almost all the companies are reworking their distribution strategies to cut the lead time to the market. This has been necessitated by high fuel prices. They are also desperate to increase prices. But success here has been elusive.

A long winter?

Meanwhile, there are some doubts as to whether Adani will press ahead with expansion plans right now.

Under normal circumstances, it made perfect sense to acquire Holcim and then expand capacity by picking up even more capacity, especially in the south. After all, demand was good in the north, west and east India—plants were operating at a high 80% capacity. High retail prices ensured good margins and strong cash flows. The south, on the other hand, was struggling with over-capacity.

But market conditions have turned rapidly adverse. The geopolitical tension that Russia’s invasion of Ukraine unleashed sent coal and fuel prices through the roof. Coal prices have shot up from $100 per tonne last year to $220 per tonne now. Add to that a 10% depreciation in the value of the rupee.

Adani has not been spared by this shock. ACC ended the September quarter with a loss of ₹87.32 crore as against a profit of ₹450.21 crore in the corresponding period last year. Ambuja Cements’ profit dropped 95% to ₹51 crore.

Understandably, the focus of the Adani management has shifted to reducing cost. According to various analysts, the mandate given to ACC and the Ambuja teams is to reduce the cost per tonne. They say that the headroom for doing so is less in Ambuja plants as it is one of the most efficient companies. Scope exists in ACC as the plants are of different vintage. This, they add, will require investments in waste heat recovery systems. These systems capture the waste heat available from the preheater exhaust gas and the clinker cooler exhaust gas of cement kilns. The captured heat is next used to generate electrical energy, reducing a cement unit’s power consumption.

Adani, analysts further say, must focus on regaining the pricing premium Ambuja Cements and ACC brands enjoyed in their main markets. In the last few years, the brands have reportedly lost out to UltraTech in many markets. All of this will consume management bandwidth.

While the capacity available in south India is alluring, any capacity that is acquired now will take a long time to generate cash, analysts warned.

Besides, there are concerns around Adani Group’s debt-funded growth plans. In August this year, credit rating agency CreditSights, a subsidiary of Fitch Ratings, stated that the group is “deeply overleveraged” and warned that in the worst-case scenario, it could fall into a debt trap and default.

So, what if Adani holds back his expansion plans in these circumstances? Things could still head south for the southern players.

Other large cement makers have announced massive greenfield expansions to ensure they retain market influence. UltraTech is planning a 200 mt capacity by 2030; Dalmia Bharat and Shree Cements plan to add 35 mt each by 2027. A fair share of this capacity will be in the south considering that the region holds 40% of the country’s limestone reserves. This would worsen the already dire surplus situation and put further pressure on prices.

Some analysts even fear a price war. Ramco’s Venketrama Raja, in an earnings call, did speak of the “increased appetite for market share among the players” as new capacity progressively enters the market.

No wonder, cement players in the south are readying for a long winter.

Download The Mint News App to get Daily Market Updates & Live Business News.

[ad_2]

Source link

John Miller has been writing about science, gaming, and tech culture for over a decade. He’s a top-rated reviewer with extensive experience helping people find the best deals on tech and more.